The burden of multiple taxation in Anambra and the relentless war thereto, amidst COVID 19 Pandemic (Part 6)

By Odogwu Emeka Odogwu

Continued from ….The burden of multiple taxation in Anambra and the relentless war thereto, amidst COVID 19 Pandemic (Part 5)

Ozalla Obosi protests continued

Nzekwu absolved Christy Ike of blame, noting that he posted her there because the former people that worked there were under investigation for conniving with the residents of the area to deprive the government of revenue.

He hailed Christy for doing an excellent job, which, he said, showed in the number of people that now came to pay their taxes.

He said there had been a gang up before then by some people who wanted to determine by themselves, what they would be paying as tax.

‘That is not acceptable. It is not the way to calculate taxes. And then, when our staff gives them the right advice and tell them to pay the correct tax, they refuse. But as a responsible organisation, we have followed the process since December last year and we call our team to make sure that they do the right thing, assess people as they can; then if they are not able to do the needful, go through the court process to obtain judgement.

‘In several cases the court has given the revenue service bench warrants, which will also go to levy execution. He insisted that they had been following the legally stipulated process for revenue recovery and would continue to do that, to see that everybody paid their taxes.

‘In order to see that things are done properly, we have engaged the residents of Ozalla. They have visited our office, we have visited them. We have educated them. Part of the problem I see here is a lack of knowledge of taxation and it is wrong for people to try to present somebody that is doing her job to be their problem because they are not having what they want,’ Nzekwu said.

He said that when the landlords visited him, they had agreed to submit themselves for tax assessment.

He said some people had submitted themselves for tax assessment and had paid their taxes. He however said some were being deceived by people that did not understand the process of tax administration.

‘That is not good and I’m happy that you people are here. Hopefully, you will be able to convey the message and tell them that it is a very simple thing: submit yourselves for tax assessment so that you will be assessed. We don’t want to take you to court. If you have paid your tax, all you will need to do is to show your tax certificate. Let me show you mine. (He brought out his tax certificate) This is my own tax certificate. If anyone comes to you, show them yours. We simply administer the tax laws which we are authorized to do. It’s unfortunate to know that the people that should pay that tax in Anambra should not be less than one million, but only about four thousand and something people have paid. So, (‘’even now we are in 2020’’), we will ensure that everybody pays their tax, no matter how much it is. When we pool the resources, we can have a better society.

On the allegation of over taxing, he retorted, ‘How do you determine outrageous amounts? We have in our records, some individuals who have 5 storey buildings and come to my office to say they want to pay N5, 000 tax. How did they determine that they should pay N5, 000 cash? Let them show you their tax statement on the basis that they arrived at the amount they want to pay.’

On the allegation of his office collecting 10% of their rents, he said he did not know what they were talking about, but insisted that the tax authority had the right to do so.

‘If you don’t tell me your income and I know you’re an importer or trader, I can use any basis and the basis that is unique to the group is what they are trying to use to collect their tax. What is wrong with that? Is that not what the law says? In any case, we are even going to give them additional tax when we find out that what they have paid is less than what they should pay,’ he vowed.

Reacting to the allegation of some people paying between N100, 000 and N80, 000 but given receipt reading only N20, 000, with the rest of the money shared, he said the Anambra State Internal Revenue Service did not give manual receipts.

‘Our system and processes are fully automated. I want to clarify that it is an allegation because Christy has now been able to get them to pay what some of them should pay. They were paying N10, 000. But I want to clarify that it is a flimsy allegation because the Anambra State Internal Revenue process of tax collection is automated. You will first obtain an ANSSID number, then you pay the right amount which is not in the system, then you must pay that amount once it’s logged in the system, then go to the bank and pay with your ANSSID number. You don’t give anybody cash. We have done this sensitization on air and told people that you don’t pay cash to anyone for tax. Pay at the bank. The system only issues receipt or certificate when it has received the money. They can’t pay 10, 000 and receive the receipt of a lesser amount because it’s not done manually. These are flimsy excuses that cannot be substantiated. Otherwise they should bring their certificates and tax receipts,’ Nzekwu challenged.

On arbitrary arrests of not just landlords, but even passers-by, visitors and in a particular situation, a security man, Nzekwu said, ‘First of all, let’s not start pointing fingers at OCHA brigade. We need to understand the functions of OCHA Brigade. The government set up OCHA Brigade to do exactly what they are doing. For us to levy an execution of a court order, what is wrong with it? Before we go anywhere to enforce any defaulter of revenue, we must go to the court. If the court orders us to take an action, what is wrong in doing that? This is a problem of ignorance and people not wanting to pay their taxes.

He however said he was unaware that the wrong people were arrested and said if anyone was arrested wrongly, his office would make amends.

On the claim by the landlords that they were ready to produce their receipts where they were short-changed, Nzekwu asked if they paid with their ANSSID numbers in the banks, there was no way they would have lesser figures from what they paid in their receipts.

He said the issue of trusting their agents or not did not arise as they did not use agents for administration of taxes.

On the issue of about 400 people being arrested so far, he said they had taken more than 500 people to court and that they would continue to levy the execution and obtain judgment from the court.

On complaints by the Ozalla landlords that their area had not been developed, Nzekwu said if they had truly paid, they should present their receipts to AIRS.

‘Someone may pay N10, 000 and it’s so much money to him. Another may pay N1m and it is not so much money to him. You see, the principle of taxation is that the bigger person pays more and the smaller person pays less. Why would a tenant be paying more tax, assuming all things are equal, than the landlord?

‘We encourage them to pay because it is the money they pay that will be used for development. The government, as you can see, is doing its best to provide more facilities, street lights, etc. Tax money paid is used to pay salaries, build infrastructure. There are some bad roads there but the government is fixing them. But remember the principle of taxation which says that tax is a compulsory payment that an individual makes without necessarily deriving direct benefits. You put your taxes into a pool, then the system takes from the pool to manage it in the best interest of all. Government is doing a lot of road works, including in Ozalla.

On whether there could be a meeting point between the Ozalla Community and the tax office, he said his job was to administer the revenue law.

He said the job of the tax payer was to carry out the civic responsibility of paying taxes. He said they would be happy to have more meetings with the landlords to engage them in carrying out their civic responsibilities.

‘I believe that the more people understand the rudiments of this tax, the more things will get easier for everyone concerned. I advise them to submit themselves and be assessed so we can assess them before March of every year, so that the meeting point can be achieved,’ Nzekwu said.

But the ordeal of the Landlords appeared not to have abated as recently, more of their members were arrested.

Anambra State Internal Revenue Service to digitize revenue collection

Anambra State Internal Revenue Service (AIRS) has announced its plans to capture and enrol all taxable adults in Anambra State into distinctive revenue accounts to transform revenue collection and payments.

The exercise would provide a simple system where taxes accrued to the state could be paid from any location within and outside the state.

A release signed by Sylvia Tochukwu-Ngige, Head, Taxpayer Education and Enlightenment Team (TEET) stated that the Executive Chairman of AIRS, Dr. David Nzekwu who stated this during a one-day ‘Internally Generated Revenue (IGR) Technology Integration’ workshop at Revenue House, Awka, explained that the exercise would help to maximize revenue due the Anambra state and bear down on avoidance and evasion as much as possible.

Dr. Nzekwu maintained that the era of designing and delivery of professional and efficient system would enable AIRS reach out to every potential taxpayer in Anambra State.

Contributing, Mr. Victor Okere of Anambra Economic Think Tank (ANETT) identified untruthfulness on the part of some IGR collectors, lack of tollgate structure and difficulties in identifying taxpayers as problems affecting revenue collection in Anambra State.

Mr. Okere noted that the solution to the problems is to have a technology-driven transparent system that would serve as a repository and single point of truth for all revenue windows in Anambra State.

Meanwhile, the Anambra State Internal Revenue Service says it has put measures in place to improve the revenue profile of the state.

The chairman of the board, Dr David Nzekwu stated this while receiving in audience the management of OLISWARREN led by Late Mr Olisa Aniunoh at his office in Awka.

According to Dr Nzekwe the state has the capacity to improve on its Internally Generated Revenue.

He thanked the consultant and his management team for the kind gesture and for partnering the government in the area of Motor Vehicle Administration (AMVAS )which he noted was fruitful.

Earlier late Mr Aniunoh explained that the visit was to encourage the board in its efforts to reposition the revenue system of the state.

Highpoints of the visit were the presentation of five Laptops and a promise to provide more five laptops, ten printers and ten generators to the State Internal Revenue Service.

PAYE enforcement

Already, the Anambra State Internal Revenue Service (AIRS) has commenced enforcement of company/business registration and non-remittance of Pay As You Earn (PAYE) in the state.

Head of PAYE Department (HPD) at AIRS, Mrs Chika Obiano said: “The enforcement took effect from Oct. 1, 2019 while payments starts off immediately with the Police, OCHA Brigade and our legal team to enforce payments’’.

Obiano explained that employers must register their company businesses with the AIRS and remit tax deductions from their staff members.

“Employers with at least four staff members are required within six months of commencing business to register with the AIRS for tax deductions from staff members’ emoluments.

“Those deductions shall be remitted to the AIRS with or without formal notification or direction from AIRS.

“Failure to do so is an offence, liable on conviction to payment of N25, 000 in addition to payment of arrears of taxes due,’’ she said.

The HPD also explained that all tax deductions must be remitted to AIRS within 10 days they were deducted.

“Employers are expected to remit PAYE deducted from their employees’ salaries within 10 days from the end of each month to avoid payment of interest and penalty for late remittances.

“PAYE remittance for each month must be accompanied with a schedule (soft and hard copies), showing employees name, tax identification number, gross salary, consolidated relief allowances; tax exempts items, chargeable income and tax deducted.

She stressed that employers must endeavour to collect receipts for any remittance made.

“Any employer, who fails to deduct the correct PAYE or having deducted, fails to remit such deductions to AIRS will be liable to penalty of 10 per cent of the tax not deducted.

“This is in addition to the amount of tax not deducted or remitted plus interest at the prevailing monetary policy rate of the Central Bank of Nigeria (CBN).’’

Meanwhile, the Anambra State Government says not more than 300,000 residents of the state pay taxes out of a population of 4.5 million.

The State Commissioner for Economic Planning and Budget, Hon Mark Okoye, made the disclosure at a news conference tagged: “2020 Budget Breakdown” in Awka.

Governor Willie Obiano had on September 24 presented the 2020 budget proposal of N137.1 billion to the state House of Assembly for approval.

Governor Obiano had tagged the budget “Accelerating Infrastructure Development and Youths Entrepreneurship’’,

Presenting the budget breakdown, Hon Okoye said the state government had put automated reforms in place to capture more residents into the tax net.

“From an Internally Generated Revenue (IGR) stand point, we are projecting N30 billion for the 2020 which will be N2.5 billion every month.

“As we speak today, we have about 300, 000 taxpayers registered in the state, and we also have about 10,000 businesses registered in Anambra.

“I can tell you that of all these numbers, less than 10 per cent are paying taxes and most of them are also paying under stated taxes.

“If we can increase that figure to 20 per cent, that will take our current IGR rate from N 1.7 billion to N3.4 billion, that doubles it.

“This is why government instituted comprehensive reforms in the state to capture many residents and businesses.

“We have the Anambra State Social Service Identity (ANSSID) number and other Automation drives across the state to get data, and also capture many residents into the tax net,’’ he said.

Hon Okoye said government needed the taxpayers’ money to drive development in the state.

“The money we are using is not government’s money, the monies are owned by the taxpayers and they are used for even distribution of development across the 21 local government areas in the state.

“Payment of taxes will help to scale up provision of infrastructure and other amenities for the 4.5 million people in the state.

“So, there is so much room for growth in the state, if we can do what is required,” Hon Okoye said.

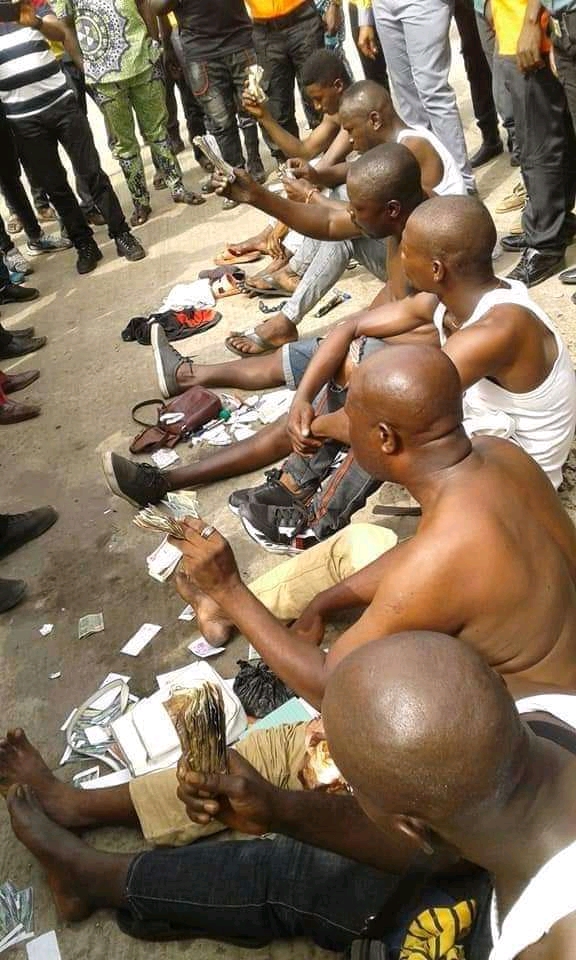

The State Chairman, Anti Touting Squad operating under the banner of Focus Initiative against Touting, FIAT, Mr. Okwudili Ohanazoeze, said they were inaugurated on December 2019 by the state government with necessary security support to rid the state of touts and touting.

He added that they have enough manpower across all the twenty-one local government areas of the state to sanitise parks and other facilities being used by touts to defraud the masses.

Shortly after their inauguration, six men were remanded in custody of the Nigerian Correctional Center, for illegal revenue collection and disrupting of activities of Anambra state Internal Revenue Service by an Awka Magistrate, Court Three, presided over by Mrs. Nonyelum Anyaegbunam.

The Six men, charged to Court by the Anambra State Internal Revenue Service included, Uzochukwu Boniface, Peter Augustine and James Obaji. Others were, Israel Ofozie, Chukwujekwu Ezike and Anthony Uzochukwu.

Messers Uzochukwu Boniface, Peter Augustine and James Obaji were charged for disrupting the activities of the Anambra State Internal Revenue Service while Israel Ofozie, Chukwujekwu Ezike and Anthony Uzochukwu were charged for illegal revenue collection.

Speaking on the matter, the Chairman, Anambra State Internal Revenue Service, Dr. David Nzekwu frowned at the attitude of some individuals who are in the habit of defrauding unsuspecting members of the public in the name of revenue collection.

As well another fifty-one (51) persons on illegal revenue collection were arrested at various locations in Onitsha by Focus Initiative against Touting at different times.

Items found in their possession were currencies, tickets with Anambra State government emblem embossment, markers, money, bundles of fake, narcotics, tickets and emblem of various states including Delta, Lagos, Rivers among others.

One of the suspects, Ifeoma Obiorah from Imo State who said she is a Nurse running a chemist shop at Owerri road narrated how one Chioma contracted her into selling the emblems for her in her absence to make additional income for her business and said that the emblems are sold for four thousand naira and pleaded for mercy from the state government as she was not aware that the said emblems were fake.

They were later granted bail in the sum of N50, 000 each on provision of sureties who must present two passport photographs and any evidence of identification approved by the Federal Government.

Some of the arrested touts, Obioma Chukwu, Igwe Leonard and Amobi Okeke, however, denied doing any wrong, while others said they were sent by some persons to collect the illegal money.

AIRS urges traders, Business owners to pay taxes, levies

Reiterating the need for tax paying, the chairman and Chief Executive Officer of Anambra State Internal Revenue Service, AIRS, Dr David Nzekwu appealed to traders and residents of the state to pay their taxes and levies.

Dr Nzekwu, who made the appeal in Awka, said the newly inaugurated Tax Compliance Team will go street to street, shop to shop to confirm that every person doing business in Anambra State pays taxes as expected by law.

The AIRS Chief said that there was need for traders in Anambra State to pay their taxes and levies to enable government generate enough revenue to carry out its responsibilities to the people.

He noted that the state has a lot of people doing one business or another but regretted that part of challenge faced by the agency was being able to get these individual business owners to pay their taxes.

Dr Nzekwu made clear that there is no provision in tax laws for market associations to collect taxes as it is the duty of tax collectors to collect taxes and tax inspectors to verify if people pay taxes and enjoined the team to take the job seriously and thoroughly verify to know, who and who had settled their taxes and levies.

Verification on in Nnewi , others

Already, Dr David Nzekwu July 22nd, 2020 led a team on verification and compliance of taxes at Nnewi where he said tax payment is a civic responsibility of every individual for more development in the state.

He lamented that many business dealers in the state do not like paying

taxes and on presentation of demand notices, end up molesting

Tax Officials which is against the tax laws.

Dr Nzekwu disclosed that his men only assist shop owners on how to pay

their business premises to ensure that illegal tax collectors do not

deceive them, stating that they do not collect money but encourage traders to pay with the

use of ANSID number

The AIRS Chairman further condemned the manner in which some people

beat and molest tax officials on duty, pointing out that two

officials were nearly killed at Nnewi and made clear that if such issues

rise again, the perpetrators will face the full wraith of the law.

Even as , he said the Anambra State Internal Revenue Service is committed to fighting illegal taxation in the State.

According to him the revenue service has been having challenges of managing people who set up revenue collection as a private business in the State.

Dr Nzekwu encouraged tax payers to always pay as at when due, to avoid penalties.

The Taxpayer Education and Enlightenment Team ( TEET), of Anambra State Internal Revenue Service are on educating taxpayers, while the tax collectors and inspectors are on the prowl in compliance to the “Revenue Compliance Verification Exercises Across the State’, even in a time like this with COVID-19 ravaging the world, grounding businesses and tearing relationships apart.

Can this burden of multiple taxation be overcome by citizens, particularly in an era like this with COVID-19 ravaging the world? Of what effect, has the relief by the state government to tax payers if at all it was implemented? Indeed, more families are in for troubled times ahead over revenue and tax payment. The question is what could be done to reduce the burden on citizens even when most of the taxes and levies ended up in private pockets?

Concluded.

Cornucopia is a weekly column of Odogwu Emeka Odogwu, PhD. Odogwu, a culture and tradition aficionado and a foodie is a known Journalist, Editor, Media Consultant and famous Blogger, as well as Social Media Entrepreneur, publisher and Conversationalist @ www.odogwublog.com among others.

Phone Number: 08060750240

E-mail : [email protected], [email protected]