Weekly report: GTCO led 61 others to undermine equity market by 2.71%

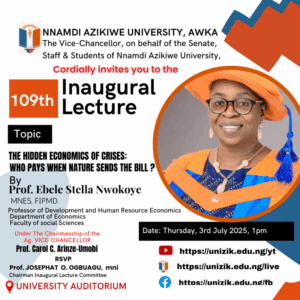

GTBANK

Guaranty Trust Holding Company Plc (GTCO) led 61 other laggard equities with a loss of N7.90 to drag the stock market indices down by 2.71 per cent, week-on-week.

Specifically, the share price of GTCO which opened the week at N41.40, shed N7.90 to close the week at N33.50 per share.

Unity Bank trailed with a loss of 38k to close at N1.62, Livestock Feed Plc dropped 34k to close at N1.45 per share.

Japaul Gold also went down by 38k to close at N1.67 and Chams Holding Company declined by 34k to close at N1.70 per share.

Consequently, the NGX All-Share index and market capitalisation depreciated by 2.71 per cent, week-on-week, to close the week at 99,539.75 and N56.296 trillion respectively.

Similarly, all other indices finisher lower with the exception NGX sovereign bond which appreciated by 3.57 per cent, while the NGX ASeM and NGX Oil and Gas indices closed flat.

Conversely, Morison Industries Plc led the gainers chart by N1.16 to close at N3.72, Guinness Nigeria followed with N5 to close at N55 per share.

Academy Press Plc added 17k to close at N1.91, Prestige Assurance Plc rose by 5k to close at 61k and Thomas Wyatt Nigeria Plc gained 17k to close at N2.14 per share.

Meanwwhile, 13 equities appreciated in price during the week lower than 19

equities in the previous week.

62 equities depreciated in price higher than 40 in the previous week, while 79 equities remained unchanged, lower

than 95 recorded in the previous week.

Also, investors traded a total turnover of 1.597 billion shares worth N32.313 billion in 44,915 deals this week on the floor of the Exchange.

This was in contrast to 1.132 billion shares valued at N28.650 that exchanged hands last week in 21,921 deals.

The financial services industry measured by volume also led the activity chart with 1.148 billion shares valued at N22.422 billion traded in 26,192 deals.

Thus, contributing 71.87 per cent and 69.39 per cent to the total equity turnover volume and value respectively.

The conglomerates industry followed with 117.629 million shares worth N1.579 billion in 2,501 deals.

The third place was the Oil and Gas industry, with a turnover of 92.498 million shares worth N810.985

million in 2,621 deals.

Trading in the top three equities namely Access Holdings Plc, United Bank for Africa Plc and Zenith Bank Plc measured by volume accounted for 570.027 billion shares worth N14.078

billion in 12,079 deals.

Thus contributing 35.69 per cent and 43.57 per cent to the total equity turnover volume and value respectively.

As part of corporate action undertaken by companies listed on the Exchange, Fidelity Bank proposed to pay dividend of 60k per ordinary share of 50k each to its shareholders on May 15.

Industrial and Medical Gases Nigeria also proposed a dividend of 50k per ordinary share of 50k each to pay its shareholders on July 14.